Which Hotel Credit Card Is the Best for 2024 Travelers? The right hotel credit card can significantly enhance your travel experience by offering rewards, discounts, and exclusive benefits. As 2024 unfolds, travelers are increasingly seeking credit cards that provide value beyond just points or miles. Whether you’re a frequent business traveler or someone who enjoys weekend getaways, choosing the best hotel credit card requires careful consideration of your spending habits, travel frequency, and the perks that matter most to you. With numerous options available from major banks and credit card issuers, it’s essential to understand the key features that differentiate these cards and how they align with your specific needs.

Understanding the Benefits of Hotel Credit Cards

Hotel credit cards are designed to reward users for their spending at hotels, airlines, and other travel-related expenses. These cards often come with sign-up bonuses, elite status in hotel loyalty programs, complimentary upgrades, and access to exclusive amenities. For example, some cards offer automatic room upgrades, free breakfast, or even free parking at participating hotels. Additionally, many hotel credit cards provide travel insurance, which can cover trip cancellations, lost luggage, and emergency medical expenses. These benefits make them particularly appealing for frequent travelers who want to maximize their savings and enjoy a more comfortable journey.

Top Hotel Credit Cards for 2024

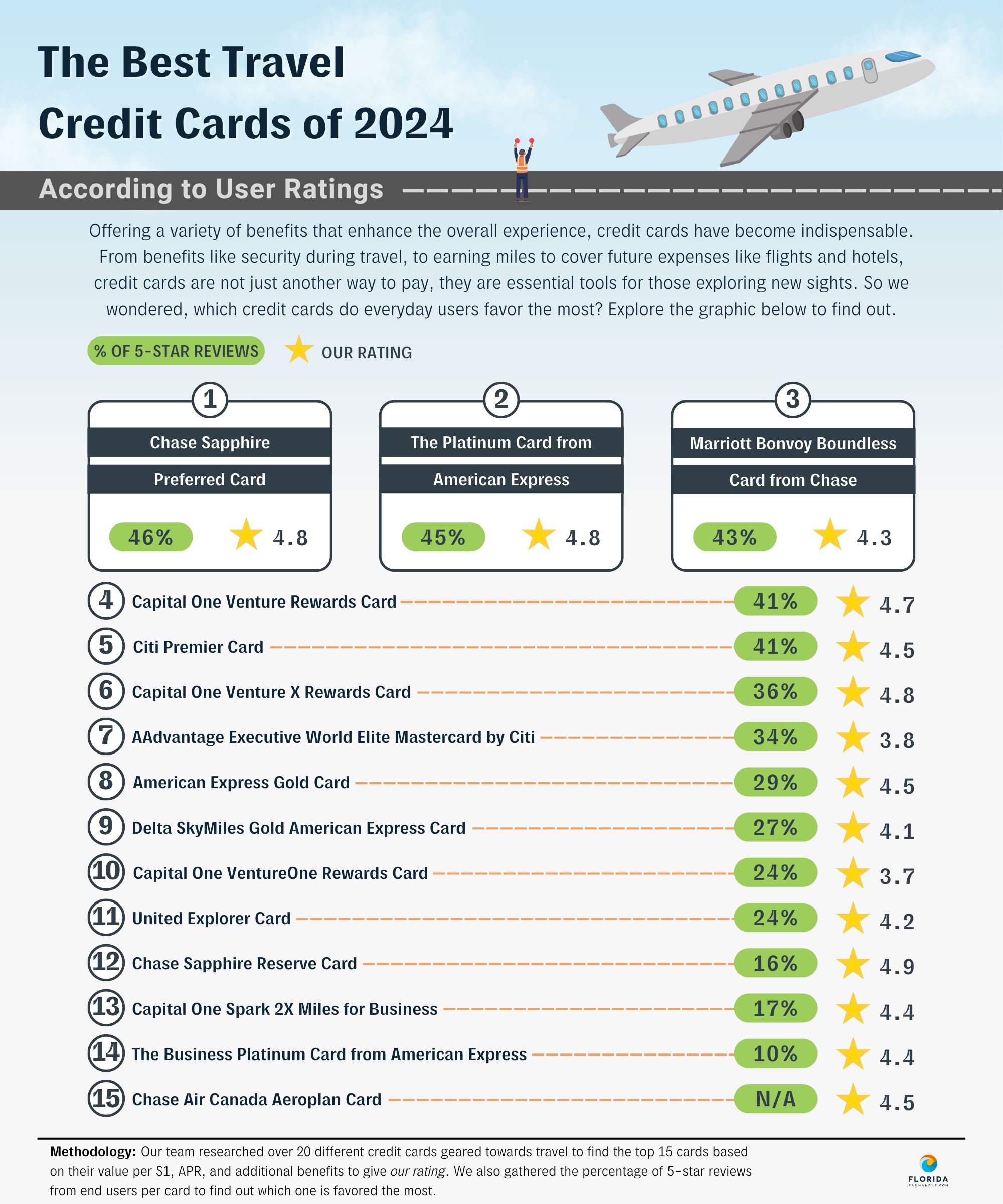

Several hotel credit cards stand out in 2024 due to their exceptional rewards and benefits. One of the most popular is the Chase Sapphire Preferred Card, which offers a generous sign-up bonus, travel insurance, and the ability to earn points that can be transferred to multiple airline and hotel loyalty programs. Another top choice is the Citi Prestige Card, known for its valuable airport lounge access, no annual fee for the first year, and a variety of travel-related perks. For those who frequently stay at Marriott properties, the Marriott Bonvoy Boundless Credit Card provides unique benefits such as free night awards, early check-in, and complimentary breakfast. Each of these cards caters to different travel styles and preferences, making it important to evaluate which one fits your lifestyle best.

Key Features to Consider When Choosing a Hotel Credit Card

When selecting a hotel credit card, there are several key features to consider. First, the sign-up bonus can provide a significant amount of value if you meet the minimum spending requirement within the first few months. Second, the annual fee should be weighed against the benefits you’ll receive. Some cards offer premium perks but come with a higher fee, while others are more affordable but may have fewer rewards. Third, the redemption options are crucial—some cards allow you to redeem points for cash back, while others offer direct booking credits or hotel stays. Lastly, the level of customer service and support provided by the issuer can impact your overall experience, especially when dealing with travel disruptions or claims.

How to Maximize Your Rewards

To get the most out of your hotel credit card, it’s important to use it strategically. This includes charging all eligible travel expenses on the card, such as flights, car rentals, and hotel stays, to accumulate points faster. Additionally, taking advantage of bonus categories, like dining or groceries, can help you reach the minimum spend requirement for the sign-up bonus more easily. Many cards also offer limited-time promotions, such as double points on certain purchases, which can further boost your rewards. By staying informed about these opportunities and using the card consistently, you can maximize the value of your hotel credit card and enjoy more travel experiences without breaking the bank.

Conclusion

Choosing the best hotel credit card for 2024 involves evaluating your travel habits, financial goals, and the specific benefits that matter most to you. With a wide range of options available, each offering unique rewards and perks, it’s essential to select a card that aligns with your lifestyle. Whether you’re looking for luxury accommodations, travel insurance, or exclusive access to amenities, the right hotel credit card can make your journeys more enjoyable and cost-effective. By understanding the features of different cards and using them wisely, you can unlock significant savings and elevate your travel experience in 2024 and beyond.