If you’re planning a trip out of the Philippines, one thing you can’t forget is the travel tax. This mandatory fee is imposed on Filipinos and certain foreign residents when departing the country, and it’s used to fund government programs related to tourism, education, and infrastructure. While it may feel like an extra cost, understanding how it works can make your travel experience smoother and more stress-free.

What Is the Travel Tax in the Philippines?

The Philippine Travel Tax is a mandatory fee that applies to Filipino citizens and certain foreign residents who are traveling internationally. It’s typically paid before departure and is used to support various initiatives, including tourism development, educational scholarships, and cultural programs. The tax does not apply to foreign tourists staying in the Philippines for less than a year, but they might still encounter a terminal fee upon departure, which is often included in their ticket price.

Who Needs to Pay the Travel Tax?

Not everyone has to pay this tax. The following groups are generally required to pay:

- Filipino citizens traveling internationally

- Permanent residents (foreigners with an immigrant visa)

- Temporary residents (foreigners holding certain types of visas)

However, there are exemptions and reduced rates for specific categories, such as Overseas Filipino Workers (OFWs), infants under 2 years old, diplomats, and crew members. These individuals may be eligible for a Travel Tax Exemption Certificate (TEC), which allows them to bypass the tax.

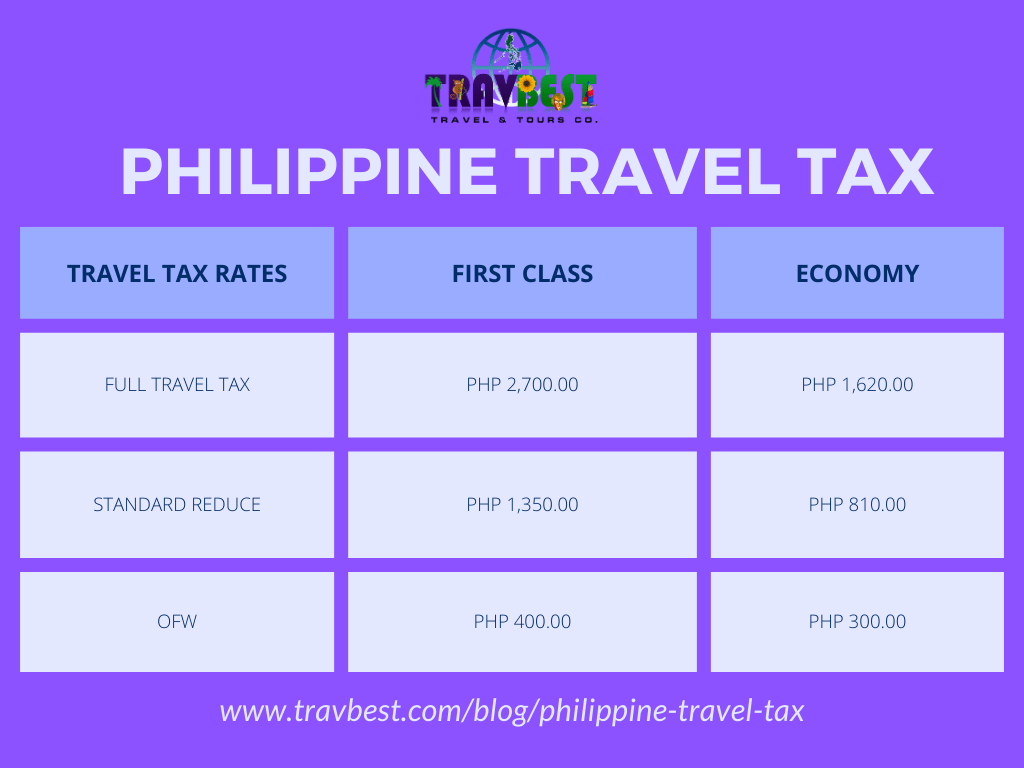

How Much Is the Travel Tax?

The standard rates for the Philippine Travel Tax are:

- PHP 1,620 for economy-class travelers

- PHP 2,700 for first-class travelers

- PHP 300–1,350 for dependents and students with reduced rates

These rates can vary based on the traveler’s status and the type of flight. For example, dependents of OFWs may qualify for a reduced rate of PHP 400 for economy class and PHP 300 for first class.

How to Pay the Travel Tax

There are several ways to pay the Philippine Travel Tax:

-

Pay Online

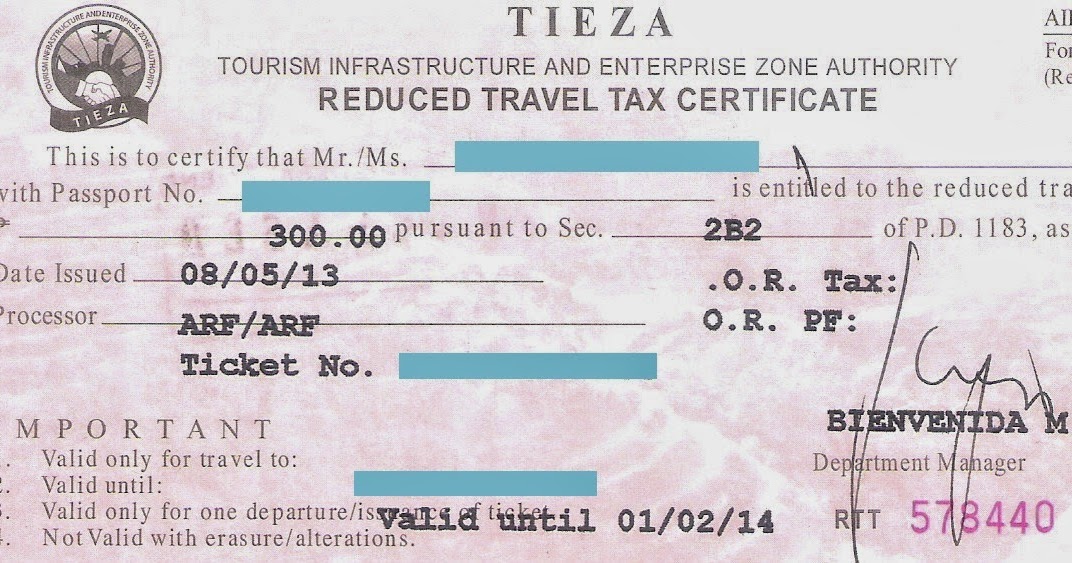

You can pay through the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) website. Visit tieza.gov.ph, click on “Travel Tax,” fill out the necessary details, and pay using your preferred method (credit card, debit card, or e-wallet). Save your receipt for proof of payment. -

Pay Through the Airline

Some airlines include the travel tax in their ticket prices, so you don’t have to worry about paying it separately. However, it’s best to confirm with your airline when booking your ticket. -

Pay at the Airport

If you forgot to pay online, you can still settle your travel tax at the airport before your flight. Head to the TIEZA counter before checking in.

Where Does the Travel Tax Go?

The revenue from the travel tax is distributed as follows:

- 50% goes to the Commission on Higher Education (CHED) for funding scholarships and educational programs

- 40% goes to TIEZA for tourism development projects

- 10% goes to the National Commission for Culture and the Arts (NCCA) to support cultural programs

Paying the travel tax helps fund education, tourism, and cultural initiatives in the Philippines—something to feel good about!

Are There Exemptions or Discounts?

Yes! Some people don’t have to pay the full travel tax, and some are even completely exempt. Here’s a quick list:

- Exemptions:

- Overseas Filipino Workers (OFWs)

- Infants (below 2 years old)

- Diplomats and foreign government officials

-

Crew members of airlines and ships

-

Reduced Rates:

- Students studying abroad

- Minors (ages 2–12 years old)

- Dependents of OFWs

To claim an exemption or discount, you need to apply through TIEZA and provide supporting documents before your trip.

Final Tips for Paying the Travel Tax

- Pay it online if you want a hassle-free experience.

- Check if your airline includes it in your ticket price.

- Arrive early at the airport if you’re paying in person.

- Check for exemptions or discounts to see if you qualify.

Travel Made Simpler with Trip.com

Paying the Philippine Travel Tax is a necessary step when traveling abroad, but it doesn’t have to be stressful. By understanding who needs to pay, knowing your options, and planning ahead, you can ensure a smooth airport experience. Even better, with Trip.com’s Travel Tax Inclusive fares, you can skip the hassle entirely and focus on what really matters — your next great adventure!

Ready to fly? Book with Trip.com today and make your travels even more worry-free!