Travel insurance is an essential investment for many travelers, especially those planning trips that involve significant financial commitments. Whether you’re booking a vacation to the United States or heading abroad, understanding the average cost of travel insurance and the factors that influence it can help you make informed decisions. In this article, we’ll explore the current trends, key considerations, and options available for U.S. travelers.

Average Cost of Travel Insurance in the U.S.

According to recent data from SquareMouth, the average cost of travel insurance in the U.S. is around $279.80 per trip, with the average trip cost being approximately $7,033.60 and lasting about 16 days. This means that travel insurance typically accounts for roughly 4% to 8% of the total trip cost. However, these figures can vary depending on several factors such as destination, trip length, and the type of coverage selected.

Travel Insurance Costs by Country

The cost of travel insurance also varies significantly based on the destination. For example:

- United States: $211-$422

- Italy: $265-$529

- United Kingdom: $214-$429

- Mexico: $119-$238

- France: $241-$482

- Spain: $201-$403

- Japan: $208-$416

- Canada: $194-$389

- Greece: $313-$627

- Portugal: $190-$380

These numbers reflect the general range of costs based on the average trip cost for each country. It’s important to note that the cost may increase if your trip involves higher-risk activities or international travel, where medical coverage and emergency evacuation are more critical.

Factors That Influence the Cost of Travel Insurance

Several key factors determine how much you’ll pay for travel insurance:

1. Trip Length

Longer trips generally require more comprehensive coverage, which can increase the premium. For instance, a 14-day trip might have a different cost compared to a 19-day trip, depending on the policy.

2. Destination

Traveling to countries with higher healthcare costs or greater risk of natural disasters can result in higher premiums. For example, traveling to Greece or Japan may come with higher insurance costs due to the potential for medical emergencies and travel disruptions.

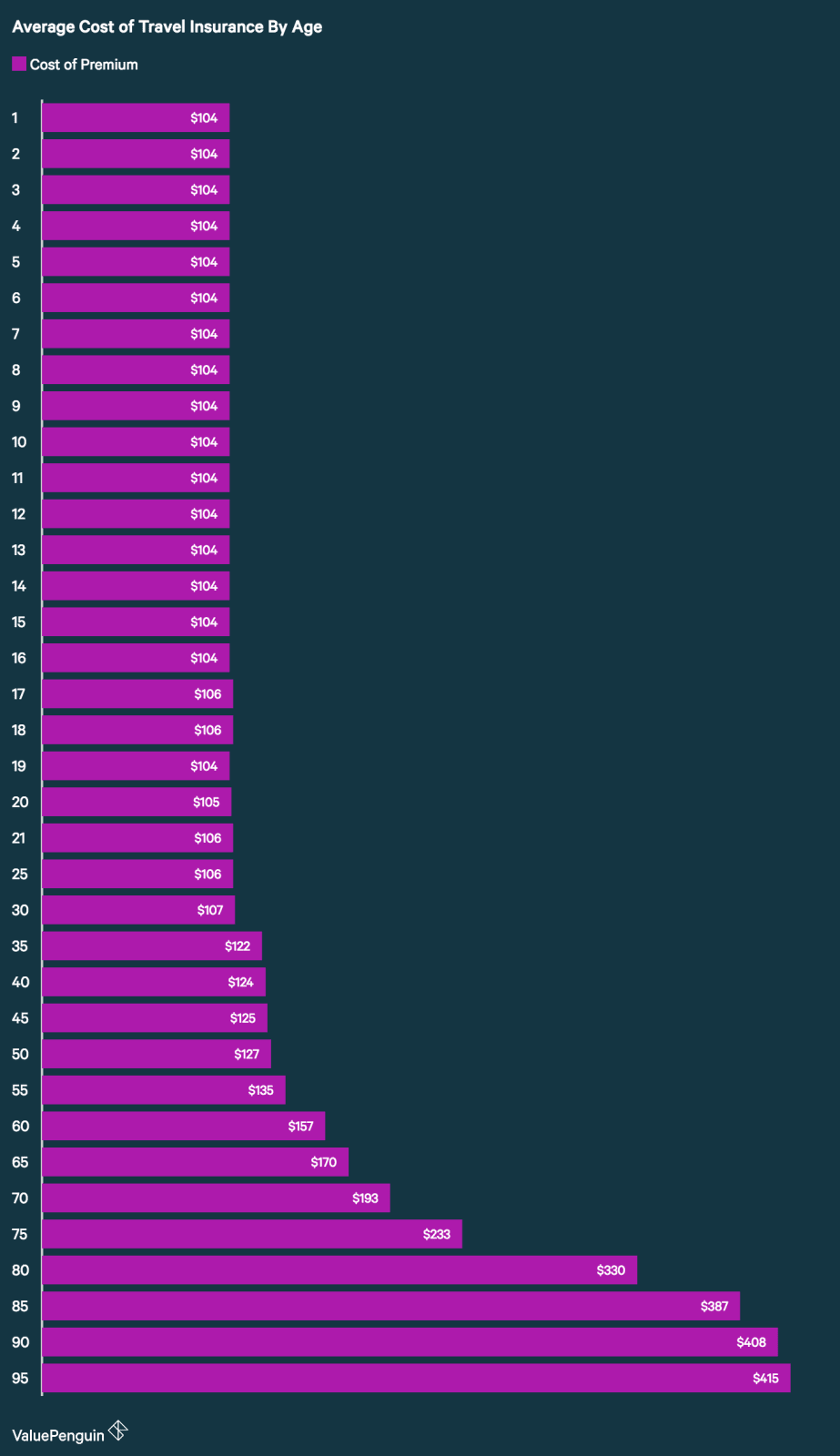

3. Age of the Traveler

Older travelers often face higher premiums because they are statistically more likely to file claims. For example, Baby Boomers (born 1946–1964) may pay up to $300 for their insurance, while Gen Z travelers (born 1997–2012) might pay around $93–$186.

4. Type of Coverage

The type of coverage you choose significantly affects the cost. Policies that include trip cancellation, trip interruption, and medical coverage will be more expensive than basic plans. Additionally, policies that offer “Cancel For Any Reason” (CFAR) coverage tend to be pricier, often costing up to 40% more.

5. Pre-Existing Conditions

If you have a pre-existing medical condition, you may need to purchase a waiver, which can add to the cost. However, some policies offer coverage for these conditions if purchased within a specific timeframe after booking.

How to Save Money on Travel Insurance

While travel insurance is a valuable investment, there are ways to reduce the cost:

- Shop Around: Compare quotes from multiple providers to find the best deal.

- Tailor Your Policy: Avoid unnecessary coverage and focus on what you truly need.

- Consider Annual Plans: If you travel frequently, an annual plan may be more cost-effective.

- Use Credit Card Benefits: Many credit cards offer complimentary travel insurance, so check your card’s benefits before purchasing a separate policy.

Top Travel Insurance Providers in the U.S.

Several reputable companies offer travel insurance, each with its own set of features and pricing:

- SquareMouth: An online marketplace that allows you to compare policies from over 30 providers.

- Tin Leg: Offers policies with generous coverage for trip cancellation and medical emergencies.

- Travelex: Provides flexible options with coverage for adventure activities and baggage delays.

- AIG Travel Guard: Known for customizable plans with high coverage limits.

Each provider has its pros and cons, so it’s essential to evaluate them based on your specific needs.

Is Travel Insurance Worth It?

Despite the cost, travel insurance can provide peace of mind and financial protection against unexpected events. According to Beth Godlin, president of Aon Affinity Travel Practice, “Travel insurance is often an overlooked investment until the unforeseen happens.” It can cover trip cancellations, medical expenses, and even emergency evacuations, which can be costly without coverage.

Conclusion

Understanding the average cost of travel insurance in the United States is crucial for any traveler looking to protect their investment. While the price can vary based on factors like destination, trip length, and age, the benefits of having coverage can outweigh the cost. By comparing policies, tailoring your coverage, and considering credit card benefits, you can find a plan that fits your budget and needs. Ultimately, travel insurance is not just an expense—it’s a smart investment in your travel experience.